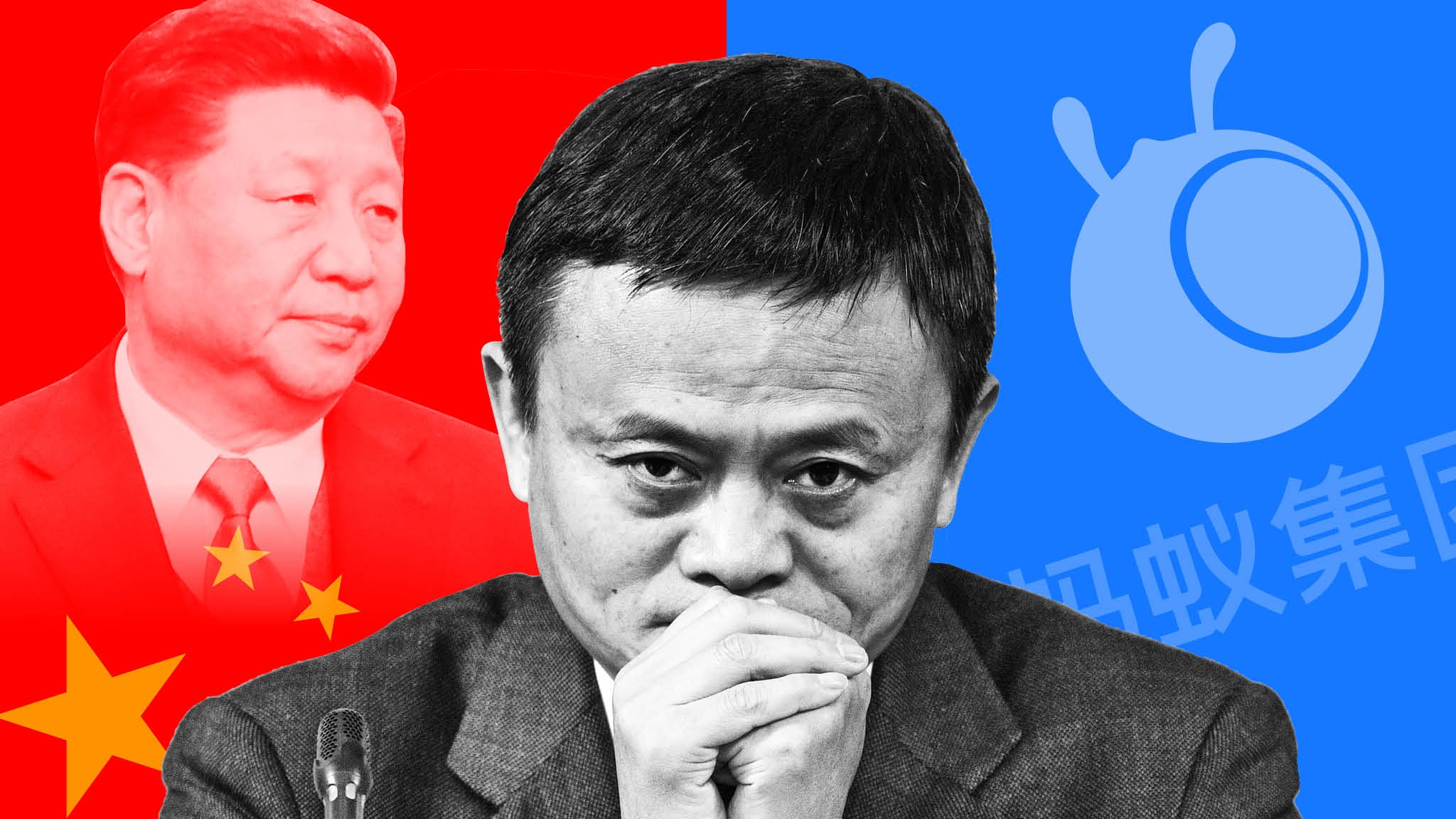

In October last year, the candid billionaire, Jack Ma publicly spoke out against the Chinese Central Party. In response to this the Chinese authorities promptly moved to quash Ant's plans for a blockbuster initial public offering and the man himself was pushed out of Alibaba Group Holding Ltd.

Heads Up

It's been eight months since Jack Ma, the most famous business executive China has ever produced, all but dropped from public view. The company related to him in these eight months has plummeted by around $70 billion (Rs 5,21,000 crores).In October last year, the candid billionaire publicly spoke out against the Chinese Central Party. Ma publicly lambasted global financial regulators and conventional bankers. He said they were out of touch and stifled innovation. In response to this the Chinese authorities promptly moved to quash Ant's plans for a blockbuster initial public offering. Authorities have since issued new rules on everything from consumer lending to leverage to monopolies in online payments. Regulators and state media have tapped into strands of popular resentment toward China's hyper-wealthy moguls, criticizing the companies for enticing the poor and the young in debt. Inside Ant, the financial-technology giant, Jack Ma was pushed out of Alibaba Group Holding Ltd.

The Ant Group is now in process to implement state-ordered business overhaul. The government authorities are even mulling the possibility of installing a government representative in Ant's senior executive ranks to keep tabs on the company, according to some sources.

These changes are happening as the big tech in China, which kept freewheeling using the internet-age capitalism, wealth and influence it had, collided with the aims and ambitions of the Chinese Communist Party. Regulators describe this as "rectification". It's also affecting the finance operations of Tencent Holdings Ltd., JD.com Inc., TikTok owner ByteDance Ltd. and ride-hailing giant Didi Chuxing. Where the U.S. and European officials have been wondering for years what to do with the big tech companies that have amassed so much power, China has answered by way of asserting control over such companies.

The Chinese Government making moves

China is now trying to get fintech under its control that means forcing new-age companies like Ant to behave more like old-fashioned banks. It also means tipping the balance of power in favour of the nation's huge, debt-ridden financial industry and connecting it back towards the state-owned bank that follow the party's propaganda. Beijing says China's big Internet and fintech companies have abused their market power.

Ant and its peers have taken some hard blows. Regulators have worked to check their influence, and the future is looking a lot less profitable. Lending online to hundreds of millions of Chinese, the biggest engine of growth, is forecast by Bloomberg Intelligence to shrink 23% over five years. Same is the case with money flowing to investment products sold by fintech platforms. The government has stepped up to closely police the digital payment ecosystem.

"We are entering a period of major upheaval as Beijing reshapes its relationship with tech giants. Expect tighter controls to stay here long-term. Beijing's priorities have shifted."

- statement by Beijing-based Liao Ming, a founding partner of Prospect Avenue Capital, which manages $500 million in assets.

Restructuring of the financial divisions of more than a dozen technology companies into entities that will be more like banks and supervised by the People's Bank of China has started. Everything from collection and usage of consumer data, to how loans are constructed and sold, and to whom, overseas listings and ownership structures is under surveilance.

More pain lies ahead

- Ant and rival Tencent have been told to cut the "improper links" that directed billions of users of their ubiquitous payment apps - Ant's Alipay and Tencent's WeChat Pay - towards higher - paying services such as loans and fund management.

- The PBOC is weighing new rules for curbing monopolies in online payments, while at the same time trying to launch a venture that would take charge of the data those platforms collect and share it with rivals.

- Earnings multiples of traditional finance companies would value Ant somewhere between $29 billion and $115 billion, according to Bloomberg Intelligence analyst Francis Chan. That's well below the $320 billion that they expected to fetch from their IPO last year. Ant's early investors are trying to stay positive. Fidelity Investments (owns 0.14% of Ant), has halved its estimate to about $144 billion at the end of February from $295 billion earlier. Warburg Pincus (owns 0.33%), has pegged it somewhere between $200 billion to $250 billion.

- Shares of Alibaba, which owns about a third of Ant, have slumped almost 30% since early November.

Economy: Ordinary people in China are hungry for loans.

Let's understand using some extracts.Extract 1:

Yang Mei runs a little beauty parlour in the southwest city of Chengdu. The 30-year-old obtained a loan of 5,000 yuan via Ant this past September to help pay for various beauty products at an interest rate of 185 yuan for three months. It's roughly equivalent of a 14.8% annual rate, which is "reasonable" according to her. She wanted to get another loan to fund an expansion but put those plans on hold after Ant was forced to restrict lending. She says she's hesitant to borrow anywhere else because she trusts the Ant brand.

Yang Mei runs a little beauty parlour in the southwest city of Chengdu. The 30-year-old obtained a loan of 5,000 yuan via Ant this past September to help pay for various beauty products at an interest rate of 185 yuan for three months. It's roughly equivalent of a 14.8% annual rate, which is "reasonable" according to her. She wanted to get another loan to fund an expansion but put those plans on hold after Ant was forced to restrict lending. She says she's hesitant to borrow anywhere else because she trusts the Ant brand.

Extract 2:

Li Lin, the owner of a food processing plant in Sichuan province that sells dairy products and hot sauce is having a hard time obtaining loans from state banks. He says even local banks are stingy with small business owners as they aren't considered prime clients. Li, 40, says he and fellow entrepreneurs continue to borrow from small online lenders that go unseen by regulators and charge usurious rates pegged to the principal even after half the loan is repaid.

Li Lin, the owner of a food processing plant in Sichuan province that sells dairy products and hot sauce is having a hard time obtaining loans from state banks. He says even local banks are stingy with small business owners as they aren't considered prime clients. Li, 40, says he and fellow entrepreneurs continue to borrow from small online lenders that go unseen by regulators and charge usurious rates pegged to the principal even after half the loan is repaid.

The big banks have now started pressing their advantage

- Last year, they collectively invested a record $31 billion in fintech. Industrial & Commercial Bank of China (ICBC) Ltd., the world's largest bank by assets, increased spending by 40% and hired 800 people in technology. Its total workforce in that one area is now 35,400!

- Its banking app increasingly mimics Alipay, bundling travel, entertainment, and dining options, with a host of financial services for its 416 million users.

- Since suspension of Ant's IPO, shares of China Merchants Bank, the retail banking leader in China, have soared almost 60%.

- Ant was told to shrink its money-market fund, once the world's largest. At the same time, the Shenzen based Merchants Bank, has opened investment products once reserved for the rich to mass-market clients. Its retail assets under management climbed by a record 650 billion yuan in the first quarter, to 9.6 trillion yuan.

- Traditional banks in China have long struggled to size up customers who don't have collateral or credit histories. But reams of new data from payment systems of platforms like Ant are helping revolutionize lending and credit rating.

- It is worth noting that even when regulators ordered top 13 fintech platforms to rein in their finance operations, they acknowledged the crucial role these new-age companies have played in improving access to customers, bringing efficiency in operations and lowering transactions costs. Thus, the government does not intend to kill them.

All in all China wants to bridle innovators without hampering innovation and reduce financial risks without diminishing economic rewards. But is it possible?

Stay Inquisitive!

Written by: Aastik Pasricha

Sources: ndtv.com, Bloomberg.com

Disclaimer: The blog does not intend to promote any political ideology in favour or against any race or country. The intention is only to share information or data for educational purposes. The above content has been garnered from various internet and news sources.

Comments

Post a Comment

Share your suggestions, ideas or thoughts